Purchasing a home is not only likely to be the biggest investment you’ll ever make, but it is also the largest debt you’ll assume in your lifetime. It pays to do your research when it comes to ways to qualify for the lowest mortgage rate. After all, just a couple of percentage points can make the difference in you paying thousands of dollars more over the course of the loan.

1. Check Your Credit Score

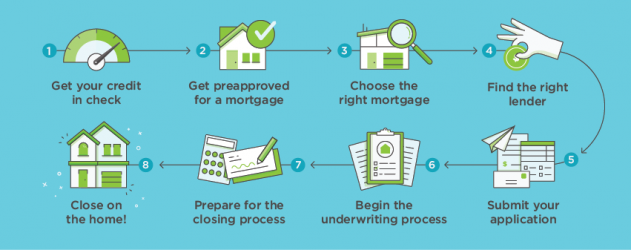

Your credit score is the single most important item when it comes to securing the best mortgage rate. Being able to improve it takes time so ideally. you should start by taking a look at your credit score at least several months before you actually want to apply for a mortgage.

According to myFICO.com, the difference you’ll be if you have the highest credit range and one that’s average is about $33,000 in total interest over the course of the loan. Ways to improve your credit score include checking your credit report for mistakes, paying off credit card debt, spending only 20 to 30 percent of your credit limit and paying your bills on time each month.

2. Determine the Best Mortgage Type

While some mortgages are limited to a certain sector of the population — the military, for example, or those who meet certain income guidelines — you can usually categorize them as either those that are backed by the federal government and conventional loans. About 65 percent of all mortgages in the United States are those issued by private lenders such as credit unions, thrift institutions, mortgage companies and commercial banks. In some cases, these conventional loans might also be guaranteed by agencies that have government ties like Fannie Mae and Freddie Mac.

Government-backed loan programs are also offered by private lenders, but the federal government acts as the full or partial guarantor. In general, these loans have lower down payments and credit score expectations than conventional mortgages. There are usually more flexible borrowing and income requirements. With these advantages, though, come stipulations regarding the loan. The borrower might live at the property as their primary residence and it cannot be used to generate rental income or as an investment.

3. Look at Loan Terms

Regardless of the mortgage lender you deal with, they are looking to reduce the risks they take by offering you a loan. This means that a shorter loan term — such as a 15-year mortgage instead of the typical 30-day mortgage — will net you a more attractive interest rate. The payoff is that your monthly payments will be much higher.

As an example, if you pay an interest rate of 4.23 percent on a $260,000 mortgage loan for 15 years, your monthly payment will be about $1,953. Secure that same loan amount and mortgage rate for 30 years and your monthly payments will only be about $1,276. By doing that, though, you’ll be paying an extra $100,000 in interest of the life of the loan.

There are a number of factors that go into the search for the lowest rate. The above three provide you with some flexible options to suit your particular situation.

Protected with 256 bit SSL

Protected with 256 bit SSL