You have lots of options when it comes to a mortgage, but one that is often overlooked is the 15-year fixed rate loan. This type of mortgage has numerous advantages, and here are just a few of them you may want to consider.

Saving Money in Interest

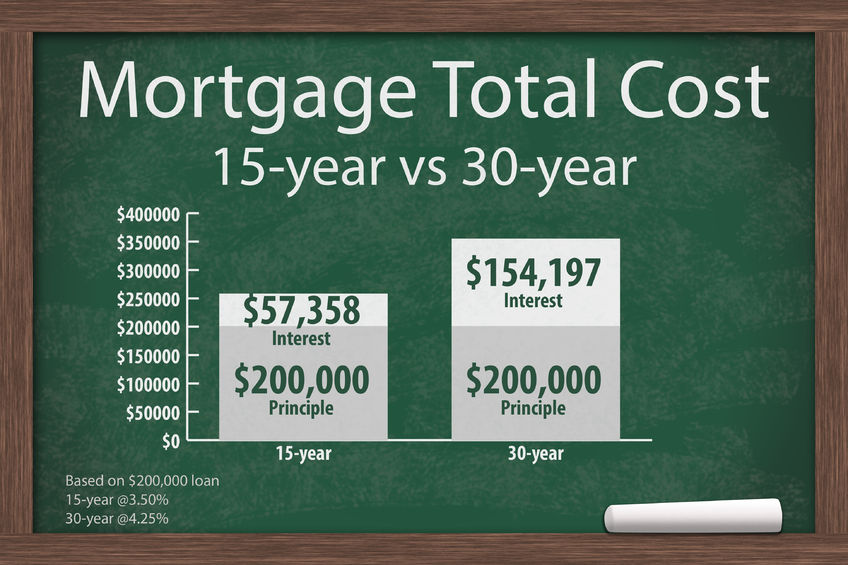

The fact that you will pay on a 15-year mortgage only half as long as you would a 30-year loan naturally means a tremendous savings in interest. Even so, a shorter term is not the only thing that saves you interest money. Short-term loans tend to come with lower interest rates to begin with, and that includes mortgages. Right off the top you could save half a percentage point or more, leaving you paying as little as one-third the amount of interest over the life of the loan.

Protected with 256 bit SSL

Protected with 256 bit SSL